Getting home loan is very BASIC now

Get a loan in under 5 mins

Are you looking for the best home loan provider in India? Then, you must compare the interest rates of the top banks for home loans in India and pick the one that offers easy home loans with the maximum benefits. This is because the loan tenures are generally for around 20-30 years, and you would not want to get stuck with a home loan scheme that feels burdensome after a few years.

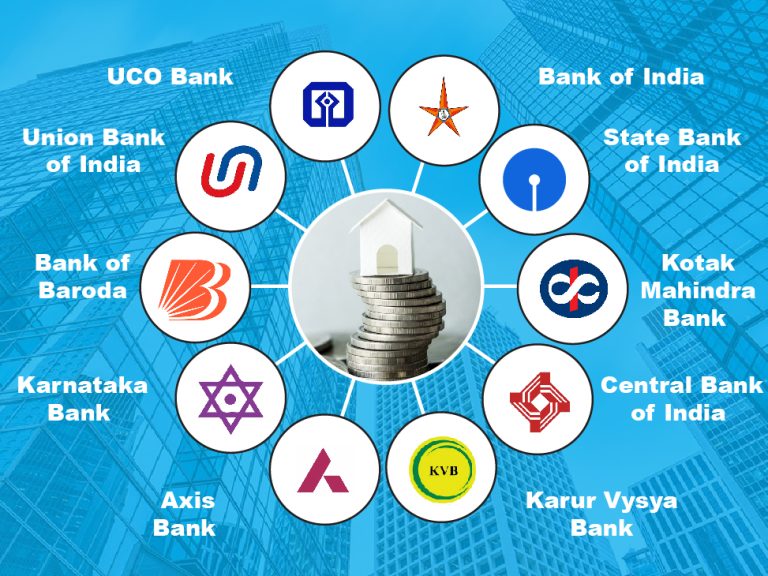

Here is India’s top best home loan bank list of 2024 for you to compare and make an informed decision before opting for a bank loan for a house purchase.

| Bank | Interest Rate | Processing Fee | Loan Amount | Loan Tenure |

| UCO Bank | 8.75% p.a. onwards | 0.5% of loan amount min. Rs. 1500 and max. Rs. 15,000 | Up to 90% of the property’s cost | Max. 30 years |

| Bank of India | 8.45% p.a. onwards | Up to 0.25% for individuals (Min. Rs. 1,500; Max. Rs. 20,000) | Up to Rs. 5 crore | Max. of 30 years |

| Union Bank of India | 8.70% p.a. onwards | 0.50% of the loan amount | Up to 90% of the cost of property | Max. 30 years |

| State Bank of India | 8.75% p.a. onwards | 0.35% – 1% of the loan amount | Up to 90% of the cost of property | Max. 30 years |

| Bank of Baroda | 8.60% per annum onwards | Up to 0.50% (Min. Rs. 8,500; Max. Rs. 25,000) | Up to Rs. 20 crores | Max. 30 years |

| Kotak Mahindra Bank | 8.75% onwards | 0.5% – 1% | Up to 90% of the cost of property | Up to 20 years |

| Karnataka Bank | 8.75% onwards | 0.50%-2% | Up to 7.50 crores | Max. 30 years |

| HDFC | 8.50% p.a. onwards | Up to 0.5% of the loan amount or Rs. 3,000 (whichever is higher) | Up to 90% of the cost of property | Max. 30 years |

| Axis Bank | 9.00% p.a. onwards | Up to 1% or min. Rs. 10,000 | Up to 5 crores | 30 years (Floater) and 20 years (Fixed) |

| Karur Vysya Bank | 8.95% per annum | Up to Rs. 7,500 + GST | As per the current market value of the property | Up to 25 years |

*Please check for the interest rates.

The UCO Bank, which is considered to be one of the best home loan banks in India, offers a starting interest rate of 8.75% p.a. while the processing fee for the loan is 0.5% of the loan amount. The bank offers house loans through two schemes – UCO Home and UCO Pre-Approved Home Loan.

The Bank of India home loan offers an interest rate starting at 8.45% p.a. while the loan processing fee is 0.25% for individuals. The maximum loan amount you can avail with Bank of India is INR 5 crores and tenure can be up to 30 years.

Suggested read: Bank of India home loan

In the case of Union Bank of India Home Loan, the starting interest rate is 8.70% p.a. onwards and the processing fee is 0.50% of the loan amount. The maximum loan tenure with this bank is 30 years and its EMIs are pegged at INR 805 per lakh.

Suggested read: Union Bank of India Home Loan

The State Bank of India, which is regarded as the best bank for housing loans in India, offers an interest rate on home loans starting at 9.15% p.a. with a processing fee ranging between 0.35% and 1% of the total loan amount. The loan tenure offered by the bank is 30 years. It also claims to levy no hidden charges besides offering a full waiver on prepayment charges.

Suggested read: SBI Bank Home Loan

The Bank of Baroda Home Loan interest rate starts at 9.15% p.a. with a processing fee of up to 0.50%. The bank offers loans up to 10 crores with the tenure being up to 30 years. One of the top features of the Bank of Baroda is that you can choose a top-up loan up to five times during the loan tenure.

Suggested read: Bank of Baroda Home Loan

Kotak Mahindra Bank, which regularly finds its name in the top best home loan bank list in India, offers a loan interest rate starting at 8.75% while its processing fee is 2% of the loan amount. The maximum loan tenure with this bank is 20 years, with pre-closure and part payment fee charges being NIL.

Suggested read: Kotak Mahindra Bank Home Loan

The Karnataka Bank’s starting interest rate is 8.75% with its processing fee being between 0.50% and 2%. The maximum tenure the bank allows is 30 years. The three loan schemes of the bank are KBL Apna Ghar, KBL Home Comfort, and KBL Ghar Niveshan.

The starting loan interest rate of the Central Bank of India is 8.35% p.a. and the one-time processing fee is up to 50%. The maximum loan tenure offered by the bank is 30 years. It offers loans for renovation, repairs, purchase of plots, and alteration of existing houses.

Axis Bank, which is considered the best home loan bank in India apart from public banks, offers interest rates starting at 9.00% p.a. on floating rate and 14% on fixed rates. The maximum tenure of the loan can be extended up to 30 years with this bank in case of floating-rate loans, and 20 years for fixed-rate loans.

Suggested read: Axis Bank Home Loan

The starting interest rate offered by Karur Vysya Bank is 6.50% p.a. and the processing fee is 1% of the loan amount or INR 10,000, whichever is higher. The maximum loan tenure you extended with this bank is 25 years.

Suggested read: Karur Vysya Bank Home Loan

Banks typically offer a variety of home loan types to cater to different needs and preferences of borrowers. Here are some common types of home loans provided by banks:

Each of these loans has specific conditions and benefits, and the suitability depends on the borrower’s needs, financial situation, and long-term objectives.

Taking a home loan from a bank can come with several benefits that make it a popular choice for many aspiring homeowners. Here are some of the key advantages:

There are public and private banks and housing finance companies (HFCs) that offer home loans. Each of these offers loan amounts at different interest rates and for different tenures. To choose the best bank for a house loan, you are required to compare them on various parameters and pick one as per your preference.

As per the RBI guidelines, you cannot get a 100% home loan from a bank or financial institution.

Be it public/private banks or HFCs, all offer affordable house loans to the loan seekers, who fulfill the eligibility criteria. In addition, those looking for further discounts on their home loan interest rates can get subsidies through Pradhan Mantri Awas Yojna Scheme, only if they meet the criteria.

Choosing the best type of home loan depends on the need of the loan seeker. Some prefer variable home loan interest rates while some go for fixed home loan interest rates.

The formula to calculate the total interest cost on your home loan is (principal x rate) divided by time = interest or (P X R) / T = I.

Each bank has its own home loan eligibility check. You can go to their websites to get more clarity on the criteria. However, some of the basic requirements are a stable income, a decent credit score, and loan repayment ability.

To apply for a home loan, you need to fill up the loan application form of the bank that you have chosen to take the house loan from.

By comparing various interest rates, eligibility criteria, processing fees, and other parameters of different banks and financial institutions.

Published on 26th July 2023