Meenakshi Taheem

Getting home loan is very BASIC now

Get a loan in under 5 mins

Purchasing property is a significant investment, and whether you are buying a home, a commercial plot, or even receiving property through a gift deed, essential costs are involved. One of the primary costs includes stamp duty in Rajasthan and registry charges in Rajasthan. These charges may need to be clarified, especially for first-time buyers. To help you navigate this process, we’ve put together a comprehensive guide on stamp duty in Rajasthan and property registration charges.

Table of Contents

When buying a property, you must legally register it with the government. To do so, you need to pay stamp duty in Rajasthan, which is a tax imposed on the transaction. Additionally, registry charges in Rajasthan are levied to cover the administrative expenses of documenting the transfer of ownership. These charges, while mandatory, can vary based on the type of property, location, and transaction details.

In this guide, we’ll explore the significance of these charges, how they are calculated, and what you need to know to avoid any surprises when completing your property purchase.

Stamp duty in Rajasthan is a tax that the buyer must pay to the state government when purchasing a property. It’s imposed under the Indian Stamp Act, of 1899, and varies from state to state. In Rajasthan, stamp duty is essential for legally validating your property documents. If you don’t pay the correct stamp duty, your property transaction won’t be recognized by law, and you may face legal issues later.

The amount of stamp duty payable depends on factors such as:

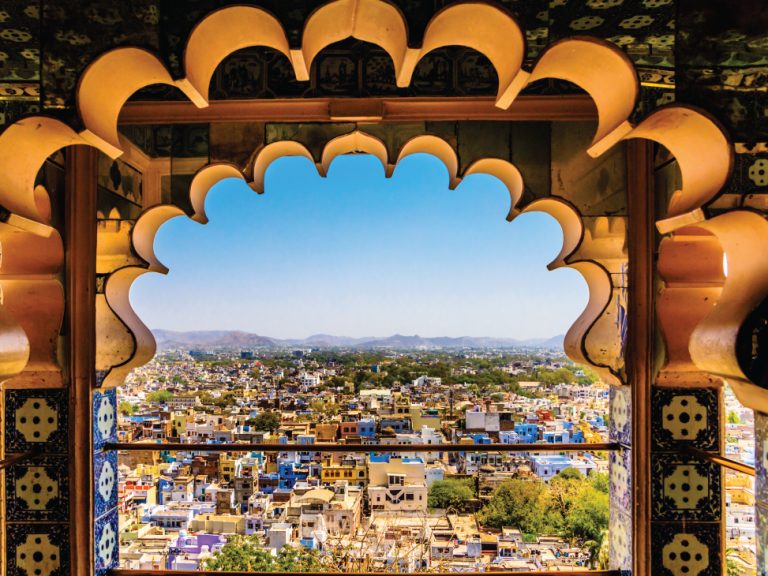

Suggested read: Affordable Housing in Jaipur

Stamp duty rates are different for residential, commercial, and agricultural properties. As of 2024, the general stamp duty in Rajasthan is structured as follows:

It’s crucial to note that these rates can change over time based on government policies, so it’s always advisable to verify the latest rates before proceeding with a purchase.

In addition to stamp duty in Rajasthan, you will also need to pay property registration charges in Rajasthan. These charges are essentially administrative fees for documenting the property’s ownership transfer in government records. These fees, known as registry charges in Rajasthan, typically amount to 1% of the property’s market value.

For instance, if you are buying a residential plot worth ₹50 lakhs, your plot registry charges in Rajasthan would be ₹50,000. These charges are mandatory and must be paid alongside the stamp duty during the registration process.

The plot registry charges in Rajasthan are uniform across the state and apply to all types of property transactions, whether you’re purchasing a residential plot, a commercial building, or agricultural land.

Suggested read: Rajasthan Housing Board Scheme

To calculate how much stamp duty in Rajasthan and registry charges in Rajasthan you need to pay, you can follow these simple steps:

Example:

Let’s say you’re buying a residential plot in Jaipur for ₹50 lakhs:

So, the total charges payable would be ₹3.5 lakhs, excluding any additional legal or documentation fees.

While the stamp duty rates discussed above apply to standard property purchases, certain transactions have different requirements. For instance:

Each type of transaction has specific rules, and it’s important to consult a legal expert or a property consultant to ensure that you are paying the correct stamp duty in Rajasthan for your particular case.

Failing to pay the correct stamp duty in Rajasthan and registry charges in Rajasthan can have serious legal implications. Here’s why you must ensure these charges are paid in full:

The process of paying stamp duty in Rajasthan and property registration charges in Rajasthan has been simplified over the years. Today, it can be done both offline and online. Here’s a quick overview of how you can complete the payment:

Additionally, it’s recommended to consult with a property lawyer or a licensed real estate agent to ensure all paperwork and payments are in order.

Final Thoughts for Property Buyers in Rajasthan

Whether you are buying a house, a plot of land, or acquiring property through a gift deed, paying the necessary stamp duty in Rajasthan and registry charges in Rajasthan is non-negotiable. Understanding these charges and ensuring they are paid properly is crucial for securing your legal rights as a property owner.

Always double-check the latest rates and policies with a professional to avoid any surprises, and you’ll be well on your way to owning property in Rajasthan.

The registration charges in Rajasthan for 2024 are 1% of the property’s market value. These charges apply across all property types, including residential, commercial, and agricultural properties.

The stamp duty on properties in Jaipur is part of the broader stamp duty in Rajasthan. It is currently set at 6% for properties in urban areas. Women buyers enjoy a reduced rate of 5%, while in rural areas, the rates are 5% and 4%, respectively, for men and women.

The DLC (District Level Committee) rate in Rajasthan is the minimum value at which a property can be registered. This rate is determined by the local government and varies across districts. The DLC rate affects both stamp duty in Rajasthan and the overall registration process. For accurate DLC rates, you should refer to the state’s official property registration portal.

For an 11-month rental agreement in Rajasthan, the value of stamp paper is generally ₹100. This value can vary based on specific local regulations or the terms of the rental agreement, but ₹100 is the standard for short-term agreements.

The stamp duty on affordable housing in Rajasthan is typically lower to promote affordable housing schemes. It ranges from 4% to 5%, depending on the location and the type of affordable housing project. This is part of the government’s effort to make homeownership more accessible.

Published on 26th September 2024