Meenakhi Taheem

Getting home loan is very BASIC now

Get a loan in under 5 mins

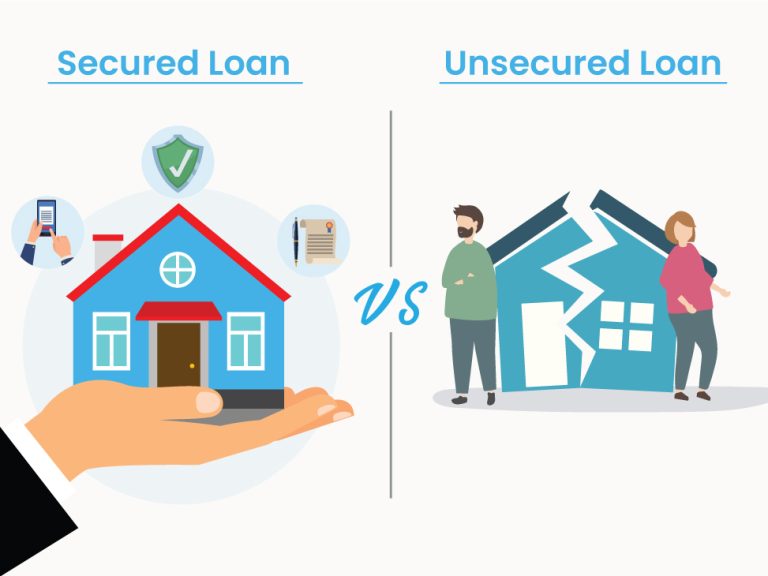

In the dynamic financial landscape of India, home loans play a pivotal role in facilitating property ownership, a cornerstone of financial stability and growth. These loans, broadly classified into secured and unsecured categories, present varied characteristics and implications for borrowers. This article delves into the nuances of secured and unsecured home loans in India, offering insights into their nature, benefits, risks, and suitability.

Table of Contents

Secured home loans are the most prevalent type in the Indian market. These loans are “secured” against collateral, typically the property being purchased. The lending institution holds a lien on the property until the loan is fully repaid. This collateral reduces the risk for the lender, often resulting in lower interest rates and longer repayment terms for the borrower.

Lower Interest Rates: The presence of collateral typically results in comparatively lower interest rates.

Longer Repayment Tenure: Secured loans often have longer repayment periods, sometimes extending up to 30 years.

Higher Loan Amounts: Given the security of collateral, lenders are generally willing to offer higher loan amounts.

Risk of Collateral Foreclosure: If the borrower fails to repay, the lender has the right to seize and sell the property to recover the loan amount.

Unsecured home loans, in contrast, do not require any collateral. These loans are granted based on the borrower’s creditworthiness, including factors like income level, credit score, and repayment history. The absence of collateral makes these loans riskier for lenders, often leading to higher interest rates and shorter repayment terms.

Higher Interest Rates: Due to the increased risk, unsecured loans typically carry higher interest rates.

Shorter Repayment Tenure: These loans generally have a shorter repayment period, often up to 5 years.

Lower Loan Amounts: The absence of collateral usually limits the amount that can be borrowed.

Dependence on Creditworthiness: Eligibility and terms largely depend on the borrower’s financial stability and credit history.

Interest Rates and Affordability: Secured loans are generally more affordable due to lower interest rates. Unsecured loans, while more expensive, provide an option for those without collateral.

Loan Tenure and EMI: Secured loans offer longer tenures, resulting in lower EMIs (Equated Monthly Instalments), but a higher total interest payout over time. Unsecured loans, with shorter tenures, lead to higher EMIs but lower total interest cost.

Loan Amount and Funding Needs: Secured loans are better suited for larger loan amounts, making them ideal for high-value property purchases. Unsecured loans are more suitable for smaller funding needs or for borrowers without significant assets.

Risk Profile: Secured loans pose a risk of losing the collateral in case of default, a significant consideration for borrowers. Unsecured loans, while posing no risk to specific assets, can adversely affect credit ratings if defaults occur.

The choice between secured and unsecured home loans depends on several individual factors:

Financial Stability: Assess your income stability and capacity to pay EMIs.

Risk Appetite: Consider your comfort level with pledging an asset as collateral.

Credit History: A strong credit history increases eligibility for favorable unsecured loan terms.

Loan Purpose and Amount: Evaluate the purpose (e.g., buying a house vs. home improvement) and the amount needed.

Future Financial Plans: Long-term financial goals and potential changes in income should influence your decision.

In conclusion, both secured and unsecured home loans in India cater to distinct borrower profiles and needs. Secured loans offer affordability and higher loan amounts but come with the risk of collateral foreclosure. Unsecured loans provide an alternative without collateral risk but at higher costs and typically lower amounts. Prospective borrowers must judiciously evaluate their financial position, risk tolerance, and long-term objectives before making an informed decision. The Indian home loan landscape, with its varied offerings, requires a nuanced understanding to navigate effectively, ensuring financial growth and stability for borrowers.

The choice between a secured or unsecured loan depends on individual needs and circumstances. Secured loans generally offer lower interest rates and higher loan amounts but require collateral, which can be at risk in case of default. Unsecured loans are better for those who do not have or do not wish to provide collateral, though they typically come with higher interest rates and lower borrowing limits.

Most home loans are secured loans. The loan is secured against the property being purchased, meaning the lender can foreclose on the home if the borrower fails to make payments.

Unsecured loans often have higher interest rates due to the increased risk to the lender. Additionally, they usually have shorter repayment terms and lower borrowing limits compared to secured loans.

From the lender’s perspective, unsecured loans are more risky as they do not have collateral to fall back on in case of borrower default. For borrowers, the risk lies in potentially higher interest rates and the impact on credit score if they fail to make repayments.

The primary risk of a secured loan is the possibility of losing the collateral (e.g., a home in the case of a mortgage) if the borrower is unable to repay the loan. This can lead to a significant financial loss and the loss of the property.

Banks provide unsecured loans as they cater to a segment of borrowers who may not have collateral but have a good credit history and income stability. These loans can be more profitable for banks due to higher interest rates, despite the higher risk.

Unsecured loans are best suited for individuals who need smaller loan amounts, do not have or do not want to risk collateral, and have a good credit history. They are often preferred for short-term or emergency financial needs.

Published on 29th January 2024