Our Benefits, your way

Door-step service

Digital customer verification/ OSV

End to end fulfillment

Step by step verification

Why Us?

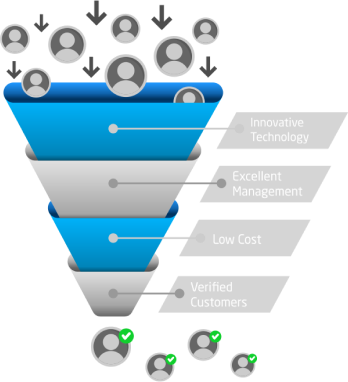

Reduction in Customer Acquisition Cost

We bring new-to-bank customers using innovative technologies, managing their entire loan application process, thus reducing the overall cost of acquisition for our lending partners.

Increase reach to tier 2 and tier 3 cities

Through our on-ground agents, we help increase penetration of mortgages in tier 2, and 3 cities where branch penetration of banks is low.

Priority Sector Lending is our specialty

70% of our loans disbursed are into the affordable housing segment.

All the above, with robust fraud control

We deploy all the latest technologies for the digital onboarding of customers (eKYC, vKYC) along with document verification via Digi Locker, to avert any customer frauds, while complying with all current regulations.

Recognition

Our Banking Partners

- We help you build Priority sector business.

- Our agents extend banks reach and bring more new-to bank customers.

- We have built a digital platform to match customers' profiles with right lenders based on their credit policy.

- In addition, we provide thorough customer verification to banks.

Partner with us