-

650

Districts

-

2,50,000

Families served

-

1,25,000

Applications processed

-

100

Lending partners

Why BASIC?

Our platform is a countrywide network of lenders, distributors, and home loan agents who are passionate about Indian low and middle income households enjoying a dignified living through affordable housing loans. We focus on making the home loan process faster, stress-free and BASIC.

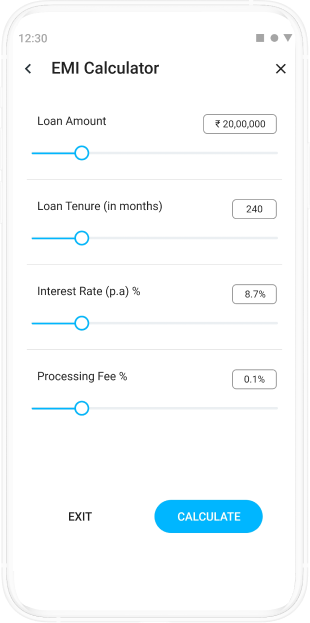

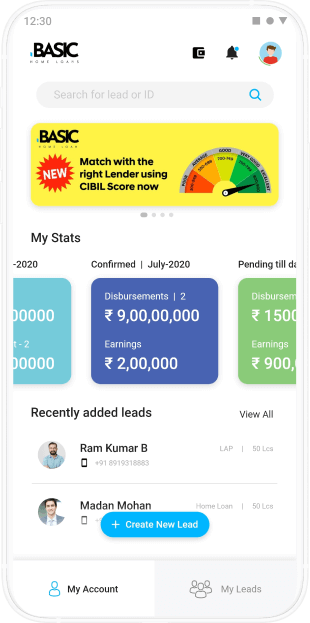

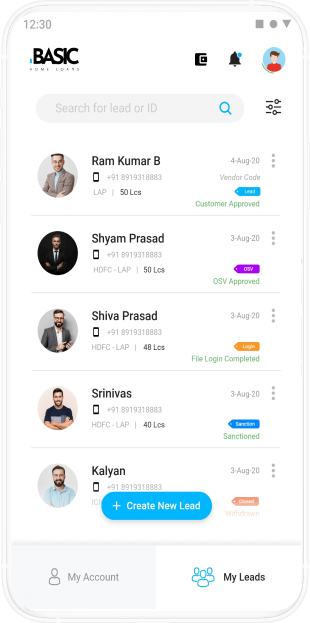

Integrated CRM Platform

Integrated CRM Platform

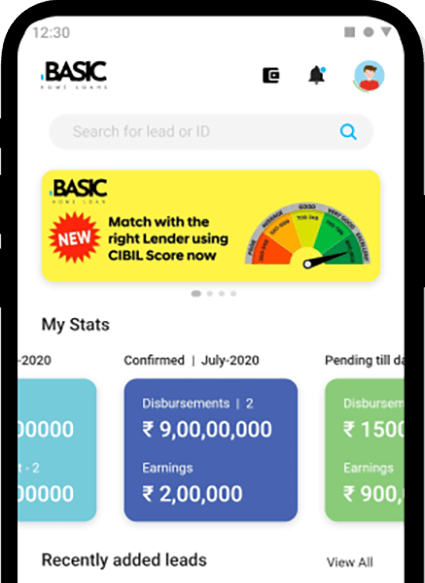

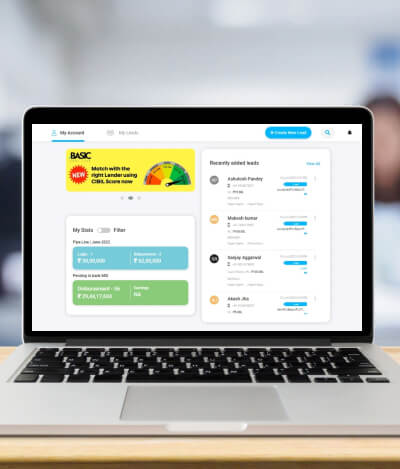

Our on-the-go app lets you track each loan approved, every payout, every reward earned with full transparency and from the comfort of your home/office.

Access To Multiple Lenders

Access to Multiple Leaders

Our platform lets you access multiple financial lenders in one go, expanding your reach, reducing waiting time, and increasing your success rate on every loan application.

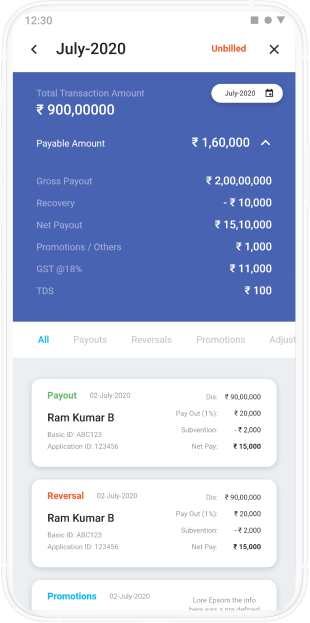

Faster & Higher Payout Cycle

Faster & Higher Payout Circle

Work with BASIC and earn up to 40% higher income. That’s not it, our payouts cycles are quicker, so you are paid faster.

Everything You Need To Grow

Everything You Need To Grow

Above all, BASIC makes your whole process of selling housing loans simple, easy and efficient.

Our Banking Partners

Agent Testimonials

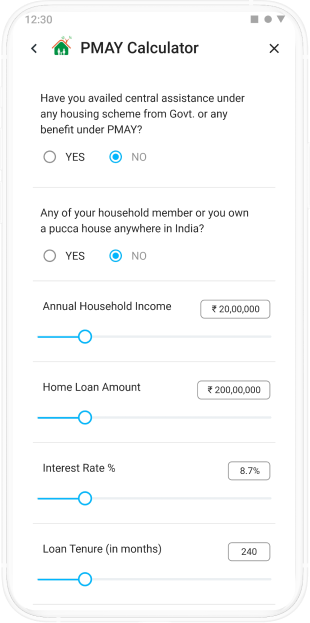

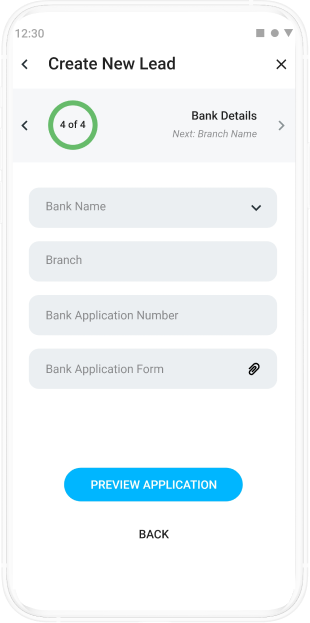

- An integrated CRM platform, ensuring transparency & security for your customer details

- Single window access to multiple financial lenders.

- Higher and faster payouts for the business delivered

- Access to an exemplary support team working round the clock for your needs

- Dedicated relationship manager for fulfilment support

- A Copy of PAN card

- A Copy of Aadhaar card

- A Cancelled Cheque

- Download the BASIC Home Loan App (link here)

- Create account on our App to register as an agent

- You will be asked to provide your name, mobile number, e-mail id, PAN number, address pincode, and select profession to open your BASIC Home Loan Agent Account

- To further verify your identity and complete profile for doing business with us, you would need to upload a copy of your PAN card and Aadhaar after login

Still have questions?

Write to us at hello@basichomeloan.com or call +91 7270 069008 anytime between 9 am – 8 pm! We are always happy to help.